So, does that mean there will be zero direct retailer dropshippers? Absolutely not. There are exceptions to this new rule. If the seller can get some kind of proof from the retailer that they have a direct partnership, and the retailer has given the seller (dropshipper) their consent, then I believe it is allowed. If that can't be provided, and the eBay seller is caught doing direct retail dropshipping, they will be banned.

But how will eBay actually find out?

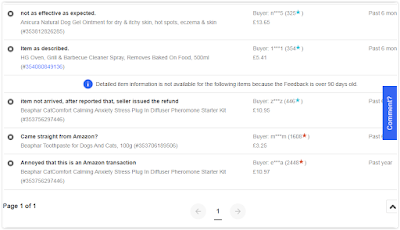

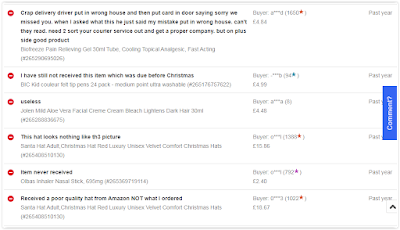

Well I'm sure that a company with millions of dollars at their disposal will be spending some of their budget on adding some new features that can help detect such behavior. Of course, simple things like adding a suspicious seller "report" button would be very effective. Along with articles educating people what to look out for, such as long delivery times, branded packaging / shipping materials like boxes from Amazon etc.

However, I think a good few people will still be doing direct retail drop-shipping, and getting away with it if their careful enough to cover their tracks. There's too much money to be made, so some sellers will take the risk. And if caught they'll just make a new account and start again.

But with this money making method now being officially banned it will make it harder to get away with, and not everyone will have the knowledge and know-how to do it successfully over a long period of time and remain undetected. Tools will more than likely be needed: Dedicated proxies, the purchasing of eBay and Paypal accounts that are a few years old (warmed up / trusted) etc.

Another Option (At your own risk)

Some companies / product suppliers actually scout for people who have trusted Amazon and eBay accounts that want to make some money by listing their inventory on the account. A percentage is usually agreed beforehand. All the money from the sales is sent back to the product supplier and the person who's account is being used is then sent their cut, which is, a lot of the time a good amount of money. Certainly worth all the bother.

Although the person who's account is being used in this way must be made aware of the potential tax bill coming their way at the end of the tax year because all sales have gone through them. But good companies / product suppliers who do this will sometimes offer cheap accounting services with the working agreement to give some peace of mind to the account owner. My opinion. You're better off just sourcing your own stock and doing things that way.